Overview

- Morgan Stanley is arranging the potential financing, which CFO Patrick Fleury said could launch as early as October via high-yield bonds or leveraged loans.

- Google increased its commitment by $1.4 billion, bringing total support to about $3.2 billion and raising its equity stake in TeraWulf to roughly 14%.

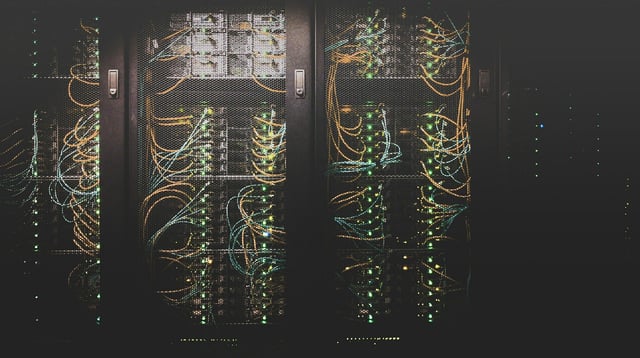

- The capital would expand and repurpose existing mining campuses into AI-ready colocation, including an expanded Fluidstack agreement in New York with reported contract revenue of about $3.7 billion.

- Credit rating agencies are reviewing the package with expectations in the speculative-grade range, and executives note the deal is not guaranteed to proceed.

- TeraWulf separately announced a $400 million private convertible notes offering due 2031, while its shares have swung sharply on the financing headlines.