Overview

- Temu's share of Google Shopping ad impressions fell from 19% on March 31 to 0% by April 12, signaling a complete pullback from digital advertising in the US.

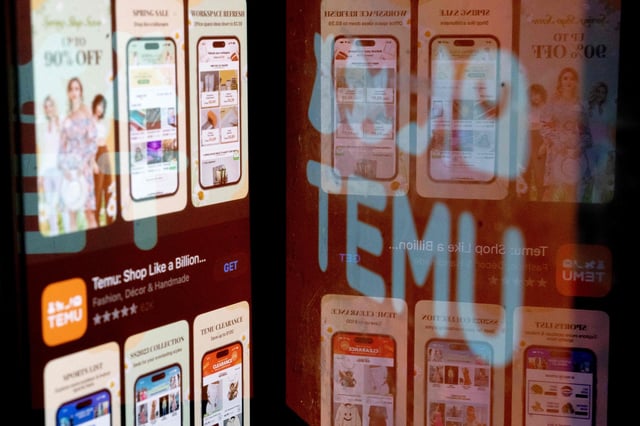

- The company's app ranking in the Apple US App Store dropped from the top-five to 64th among free apps within days of its ad retreat.

- New US tariffs on Chinese goods, reaching up to 125%, and plans to triple small-parcel shipping fees have pressured Temu to adjust its business strategy.

- PDD Holdings, Temu's parent company, has seen its stock price decline from $125 to $94.40 in April, reflecting investor concerns over the company's US prospects.

- Temu's rapid withdrawal highlights the impact of trade tensions and regulatory changes on Chinese e-commerce platforms operating in the US market.