Overview

- President Trump's executive order ends the de minimis exemption for goods under $800, subjecting them to tariffs up to 145% starting May 2.

- Temu's app store ranking fell from #1 to #11, and the company has ceased Google Shopping ads and sharply reduced social media ad spending.

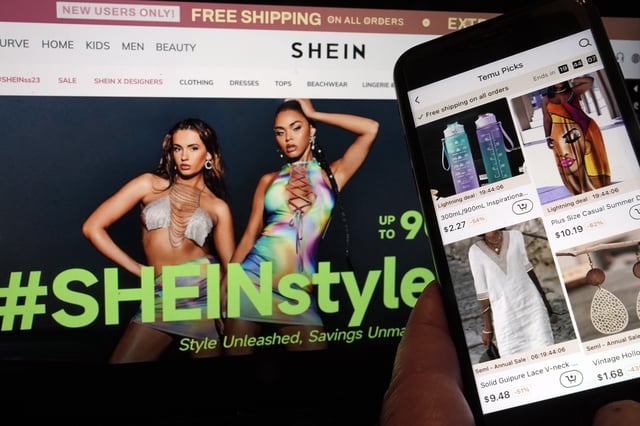

- Both Temu and Shein have announced price increases for U.S. customers effective April 25, citing higher operating costs due to the new tariffs.

- PDD Holdings, Temu's parent company, has seen its U.S.-traded shares drop by 22% this month as the tariff changes disrupt its business model.

- The removal of the de minimis provision impacts up to 4 million low-value parcels daily, undermining the ultra-low-price strategies of both retailers.