Overview

- U.S. stock futures rose Wednesday as investors ramped up bets on a September Federal Reserve interest rate cut, with CME FedWatch odds climbing above 85%.

- Major indexes recovered from Tuesday losses, driven by strong earnings beats from Apple which surged over 4% and other S&P 500 companies reporting better-than-expected profits.

- Economic data this week underscored uneven growth, with a flat July services PMI and disappointing jobs revisions fueling volatility before the rebound.

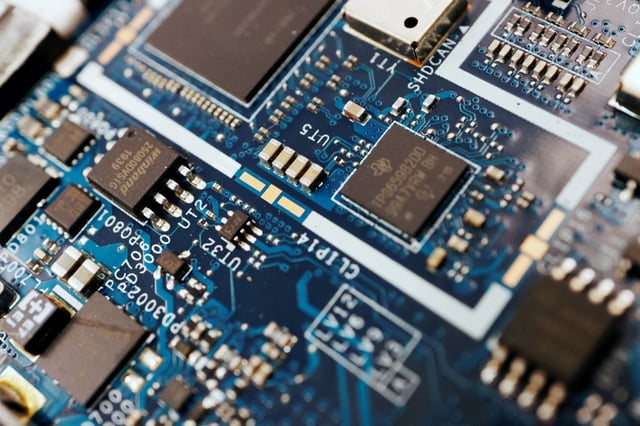

- President Trump’s new tariffs on Indian imports and proposed levies on pharmaceuticals and semiconductors increased pressure on markets already navigating global trade disputes.

- Political moves, including the firing of the Bureau of Labor Statistics commissioner and the unexpected resignation of a Fed governor, heightened uncertainty around economic policy decisions.