Overview

- Randi Weingarten, president of the American Federation of Teachers, sent a letter to six major asset management firms urging a review of Tesla’s valuation, citing risks to $4 trillion in retirement assets tied to union members' pensions.

- Tesla’s stock has dropped 30% in 2025, with its market capitalization falling below $1 trillion for the first time since November, raising concerns about overvaluation and financial instability.

- The union highlighted sharp declines in Tesla’s sales, including a 45% year-on-year drop in Europe and a 12% annual decrease in California, Tesla’s largest U.S. market.

- Weingarten emphasized Tesla’s eroding pricing power, missed profit margin expectations, and growing competition in the EV market, including from new charging networks backed by major automakers.

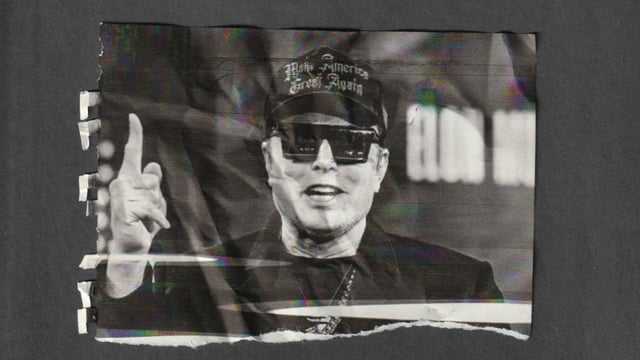

- The union also pointed to Tesla CEO Elon Musk’s controversial political involvement as a factor in the company’s declining brand favorability, which has reached an all-time low of 3%.