Overview

- Taxpayers in 10 states have until June or July to file due to federally declared disasters like storms and wildfires.

- Automatic extensions are granted in disaster areas, no application necessary.

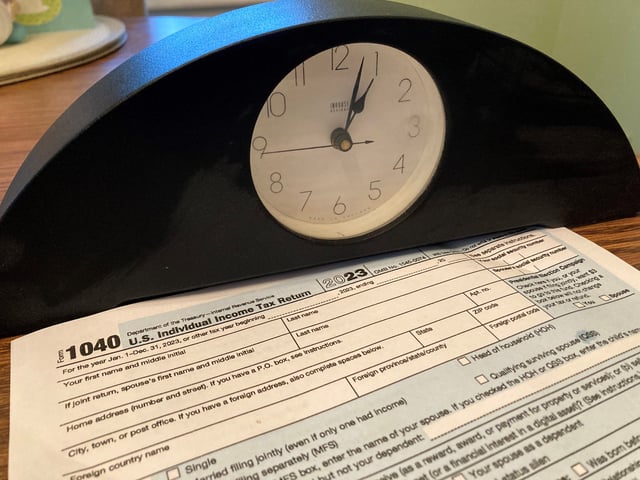

- IRS Form 4868 allows for a standard six-month extension, but taxes owed must still be paid by April 15.

- Late payment penalties apply if taxes are underpaid, with potential relief through explanatory letters to the IRS.

- Experts advise careful estimation of taxes owed when filing for an extension to avoid penalties.