Overview

- U.S. Institute for Supply Management’s services PMI held at 50.1 in July, showing stalled orders, weakening employment and the largest input-cost jump in nearly three years.

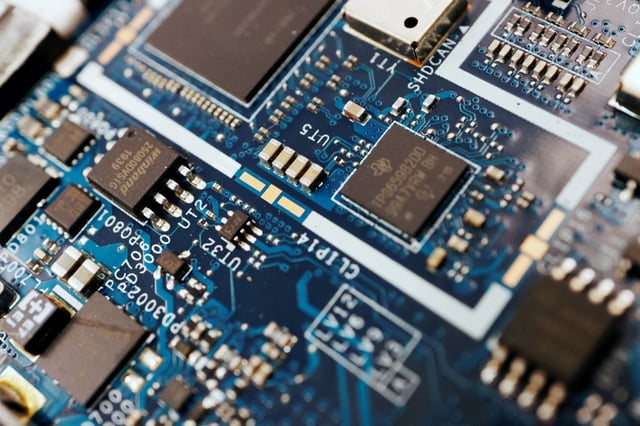

- President Trump said he would start with a small tariff on pharmaceutical imports before raising duties to triple digits and plans to announce new semiconductor levies within days.

- Wall Street’s major indexes slipped as renewed trade tensions and disappointing economic gauges offset last week’s record highs.

- The CME Group’s FedWatch tool places the odds of a September rate cut at about 85.5%, up sharply from mid-July.

- European and Asian bourses extended modest advances even as oil prices fell to five-week lows and Palantir shares jumped after reporting over $1 billion in quarterly revenue.