Overview

- The Reserve Bank of India (RBI) proposed stricter guidelines for gold-backed loans, including reducing the loan-to-value ratio to 75%, banning re-pledging until full repayment, and requiring extensive documentation.

- Tamil Nadu Finance Minister Thangam Thennarasu criticized the measures as 'deeply insensitive' and a 'systemic injustice,' arguing they harm poor and middle-class families reliant on gold loans for emergencies.

- Thennarasu called on the RBI to adopt more compassionate, people-centric financial policies to ensure accessibility for vulnerable borrowers.

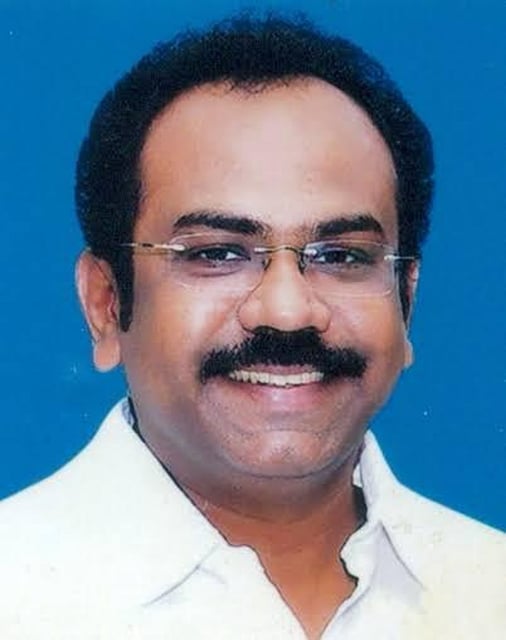

- Tamil Maanila Congress (TMC) President G. K. Vasan also urged the RBI to reconsider the restrictions, warning of adverse effects on farmers, micro and small businesses, and low-income households.

- As of May 22, 2025, the RBI has not indicated any plans to revise or withdraw the proposed guidelines despite growing political pushback.