Overview

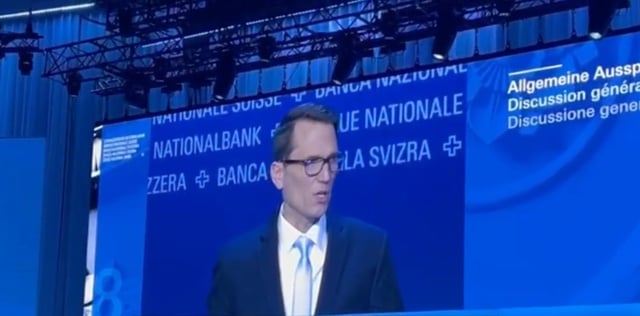

- The Swiss National Bank (SNB) has formally rejected the idea of holding bitcoin as part of its foreign reserves, reaffirming its stance during its annual meeting on April 25, 2025.

- Chairman Martin Schlegel emphasized that cryptocurrencies do not meet the bank's reserve standards due to extreme price volatility, insufficient liquidity, and potential security vulnerabilities.

- Cryptocurrency advocates are campaigning for a constitutional referendum to mandate the SNB to hold bitcoin alongside gold, arguing it could hedge against inflation and global economic risks.

- Proponents highlight bitcoin’s fixed supply and independence from political influence, especially as concerns grow over U.S. trade policies and a shifting multipolar economic order.

- The SNB currently holds no bitcoin, with three-quarters of its reserves in U.S. dollars and euros, and remains skeptical despite Switzerland's broader embrace of blockchain and digital assets.