Overview

- A referendum campaign launched in December seeks to mandate the Swiss National Bank (SNB) to allocate 1–2% of its reserves to bitcoin alongside gold.

- Advocates argue bitcoin could reduce reliance on politically influenced currencies like the U.S. dollar and euro, which make up 75% of SNB's reserves.

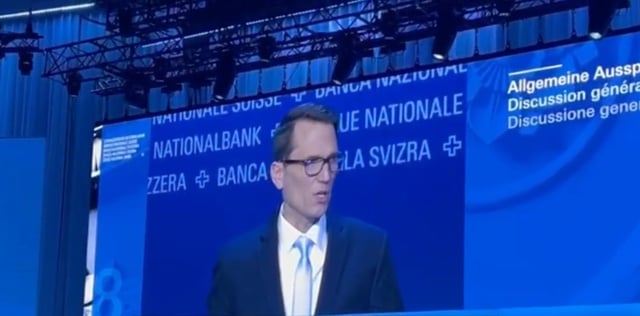

- SNB leadership remains skeptical, citing concerns over bitcoin's volatility, liquidity, and security vulnerabilities, reaffirming it holds no cryptocurrency.

- Switzerland's blockchain-friendly legal framework, including the DLT Act, and its role as a global crypto innovation hub bolster the campaign's momentum.

- The debate intensifies as the SNB's annual general meeting approaches, with campaigners leveraging U.S. tariff-driven market instability to support their case.