Overview

- The ruling was a major setback for conservative efforts to dismantle the CFPB.

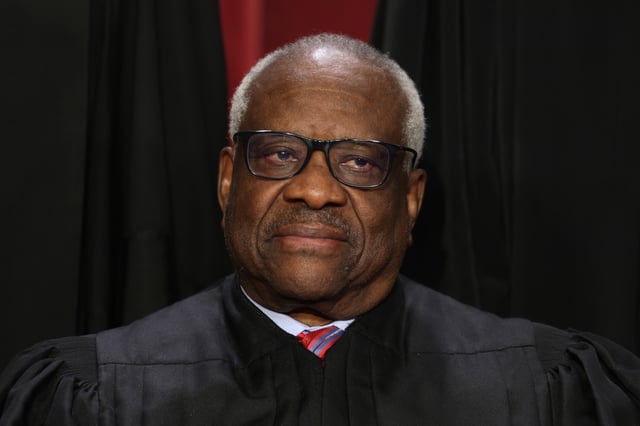

- Justice Clarence Thomas authored the majority opinion, joined by both conservative and liberal justices.

- The decision maintains the CFPB's ability to draw funds directly from the Federal Reserve.

- Dissenting justices argued that the funding mechanism violates the Appropriations Clause.

- The case was initially brought by payday lenders challenging CFPB regulations.