Overview

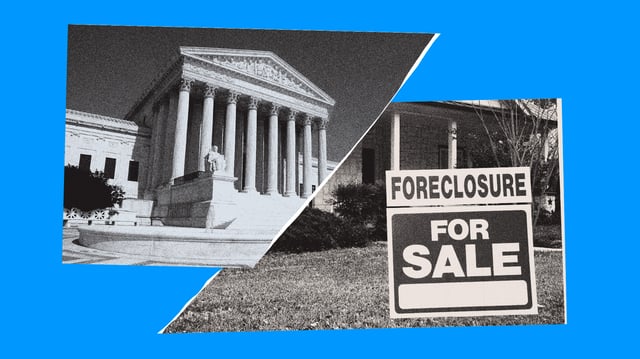

- The Supreme Court is likely to give a 94-year-old woman another day to recoup some money after the county kept the entire $40,000 when it sold her condominium over a small unpaid tax bill.

- Home equity seizure is legal in roughly a dozen states that authorize municipalities to take possession of a home in the event of delinquency, sell the property and keep the entirety of earnings, regardless of the value of the outstanding tax bill.

- Tyler owed $2,300 in taxes, plus roughly $13,000 in interest, penalties and costs, when Hennepin County took the title to the one-bedroom apartment in 2015.

- The county sold the apartment for $40,000, which was about $25,000 more than the amount Tyler owed in unpaid taxes.

- Homeowners altogether lost more than $860 million in the 8,950 homes that localities and private investors foreclosed on then resold for more money than what was owed in taxes.