Overview

- The Court held on June 12, 2025, that the U.S. Tax Court lacks jurisdiction once the IRS has settled a taxpayer’s liability.

- Jennifer Zuch’s dispute began in 2012 after a $50,000 payment was credited to her then-husband’s account instead of hers.

- After applying her overpayments to the 2010 balance, the IRS moved to dismiss Zuch’s case for lack of a proposed levy.

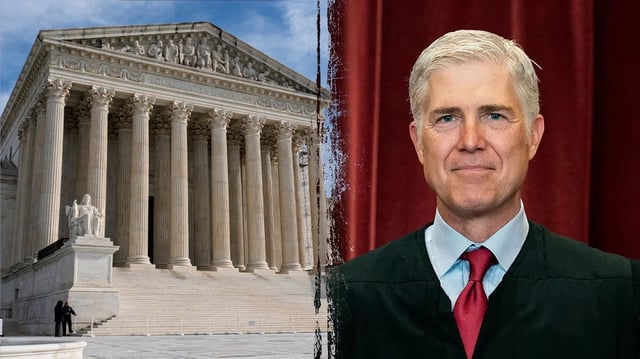

- Justice Neil Gorsuch dissented, warning the ruling equips the IRS with a tool to evade accountability for future mistakes.

- Observers say the ruling could curb taxpayers’ ability to seek redress and spur calls for legislative or regulatory changes.