Overview

- The transaction includes $40 million in cash plus 10 million SunPower shares and is slated to close this week pending stockholder approval.

- SunPower projects a larger national footprint to 45 states, a doubled 1099 salesforce, more than 5,500 additional contracts a year, and a 14% higher average selling price per installation.

- Sunder forecasts $74 million in 2025 sales on 46 MW of contracts, which SunPower says could translate into as much as $247 million in combined sales and EPC revenue, with sales contributions starting in Q4 2025 and EPC ramping in 2026.

- Sunder’s order base is 93% third-party ownership, and SunPower cites an IRS clarification preserving the ITC for TPO-funded residential systems as a key support for the deal.

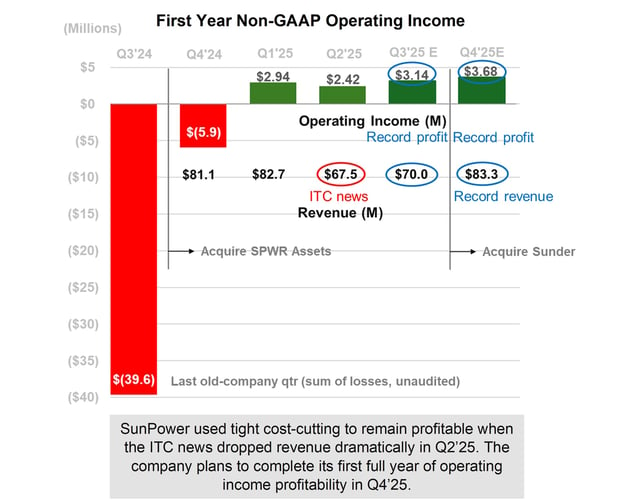

- SunPower financed the acquisition through a private offering of convertible debentures managed by Cantor Fitzgerald, and leadership expects operating profits in Q3 and Q4 2025.