Overview

- The Times reported that in 1996 Starmer placed the seven‑acre Oxted field into a trust naming his parents as beneficiaries, which would have kept its value out of their estates for inheritance tax purposes.

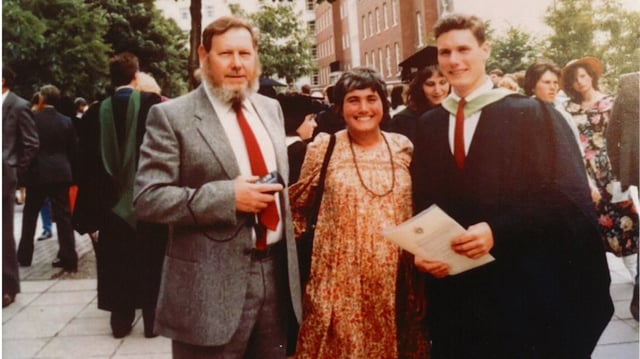

- Starmer told the BBC he did not use a trust and said he bought the £20,000 field so his ill mother could keep and see her donkeys, adding he gifted its use while retaining legal title.

- Downing Street said Starmer sought independent advice from a leading tax KC following inquiries, and the review concluded there was no tax underpayment.

- Legal analyst Dan Neidle said the structure described by The Times would be tax‑efficient under inheritance tax rules, with Section 54 meaning the asset would not enter a deceased beneficiary’s estate if it reverted to the settlor.

- Probate records put Starmer’s father’s 2018 estate at £374,091, and including the field at its eventual 2022 sale value would have raised it to about £669,830, with any inheritance tax liability dependent on available allowances at the time.