Overview

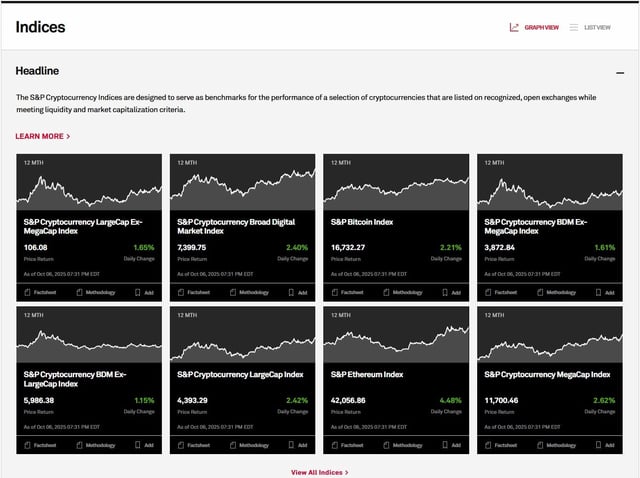

- The index combines 35 publicly traded companies tied to blockchain and digital-asset services with 15 cryptocurrencies drawn from S&P’s existing digital asset indices.

- Dinari collaborated on the design and plans to issue a dShares token that tracks the benchmark directly on-chain by year’s end.

- S&P’s methodology caps any single asset at 5%, sets minimum market caps of $100 million for equities and $300 million for new crypto additions, and follows quarterly rebalancing and governance.

- S&P frames the effort as meeting rising institutional demand across North America, Europe, and Asia for standardized exposure to digital assets.

- The announcement comes during a crypto market upswing, with one report noting bitcoin hit a new all-time high the day before and crypto-linked stocks showing strong year-to-date gains.