Overview

- The KOSPI fell 61.99 points, or 1.99 percent, to close at 3,054.28 on July 4 as investors booked profits after a recent rally

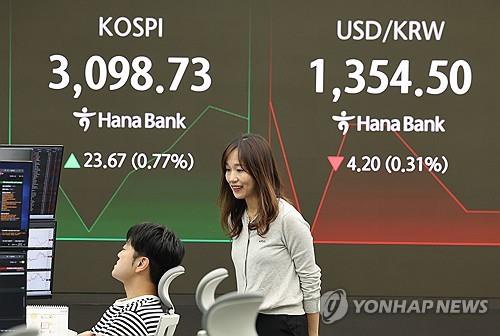

- Thursday’s surge to 3,116.27 marked a near four-year high driven by a U.S.–Vietnam tariff agreement and National Assembly approval of Commercial Act reforms

- Market focus has shifted to the July 8 expiration of a 90-day suspension on 25 percent reciprocal U.S. tariffs, with Trade Minister Yeo Han-koo en route to Washington

- Institutional investors led the sell-off by net selling 444.03 billion won, while retail and foreign investors net bought 257.06 billion and 162.27 billion won respectively

- The South Korean won weakened to 1,362.3 won per dollar at market close on July 4, reflecting growing uncertainty over U.S. trade policy