Overview

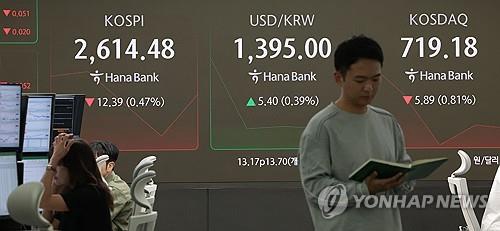

- The KOSPI closed down 0.89% at 2,603.42 on May 19, reflecting institutional and foreign investor sell-offs.

- Moody's downgraded the U.S. sovereign credit rating from Aaa to Aa1, citing rising deficits and debt costs, which unsettled global markets.

- The South Korean won weakened to 1,397.8 per dollar, marking a decline of 8.2 won from the previous session.

- Tech and auto stocks, including Samsung Electronics and Hyundai Motor, saw losses, while biotech and battery shares like Samsung Biologics gained.

- South Korea's finance ministry pledged to monitor financial and FX markets closely, emphasizing that the downgrade's impact should remain limited.