Overview

- A typical dual-income couple retiring in 2033 may lose $16,500 annually in benefits.

- The Social Security program is currently paying out more than it collects in payroll taxes.

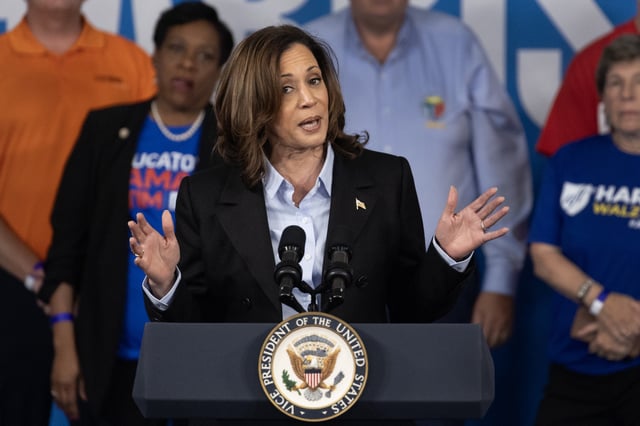

- Both presidential candidates have pledged to protect benefits but lack concrete reform plans.

- Proposed solutions include raising payroll taxes or cutting benefits to ensure long-term solvency.

- Without action, benefit reductions could deepen to 31% by 2098, further straining retirees.