Overview

- SK Hynix posted $9.66 billion in Q2 2025 memory-chip revenue for a 36.2% market share, surpassing Samsung’s $8.94 billion and 33.5%.

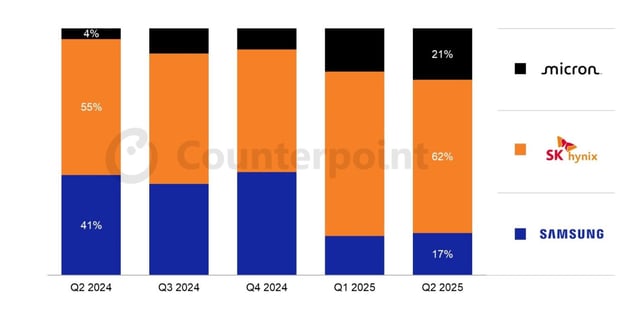

- The company captured 62% of the high-bandwidth memory segment by accelerating production of HBM3 and HBM3E modules for AI applications.

- Samsung’s HBM shipments slid to 17% as low yields and quality setbacks kept its modules out of key NVIDIA supply chains.

- Counterpoint Research data shows SK Hynix’s memory operating profit climbed to a two-and-a-half-year high while Samsung’s margins fell since mid-2024.

- Samsung is ramping up next-generation HBM4 development and diversifying customers to reclaim lost market share.