Overview

- The government remains closed after negotiators failed to agree on a funding bill that includes the expiring enhanced premium tax credits, which end Dec. 31 without congressional action.

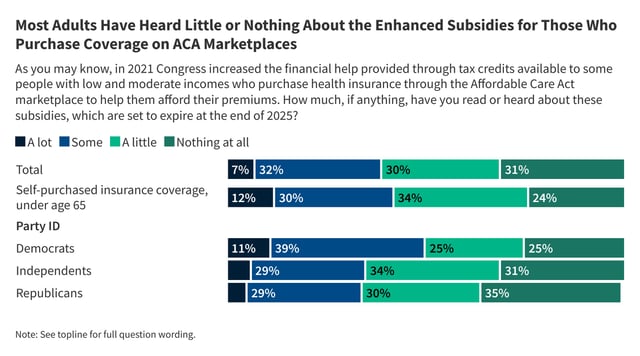

- A KFF survey conducted Sept. 23–29 finds 78% support extending the credits, including 59% of Republicans and 57% of MAGA supporters, with more saying they would blame President Trump or congressional Republicans if they lapse.

- KFF estimates subsidized enrollees’ average annual premiums would jump 114% in 2026, and the CBO projects roughly 4 million people could lose coverage next year.

- Insurers’ 2026 rate proposals reflect the uncertainty, with Ohio filings ranging from 2.5% to 42% and companies such as Centene seeking 25%–28% and CareSource about 17%.

- State regulators face an Oct. 15 deadline to finalize rates before ACA open enrollment begins Nov. 1, and extending the credits is estimated to cost about $350 billion over a decade.