Overview

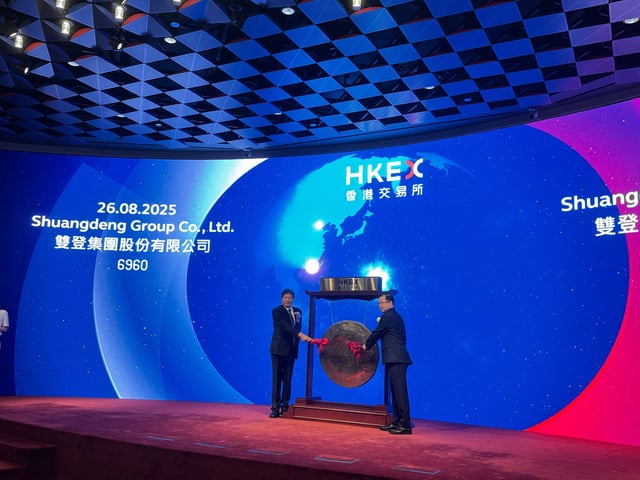

- The stock began trading at HK$22.50 versus a HK$14.51 offer price under ticker 6960, marking one of the year’s stronger Hong Kong debuts.

- Retail subscriptions were reported at roughly 3,300 times the shares available, with tightened clawback rules seen as channeling demand into first-day trading.

- State-owned Sanshui Venture Capital took a cornerstone stake worth 220 million yuan with a one-year lock-up.

- Shuangdeng plans to deploy proceeds with about 40% for a new lithium-ion plant in Southeast Asia and 35% for an R&D hub in Taizhou, with the balance for overseas sales efforts.

- Chairman Yang Rui linked growth to AI-driven demand and overseas expansion, as Hong Kong listings by Chinese firms reached about US$16.5 billion in 2025, including CATL’s US$4.6 billion secondary listing in May.