Overview

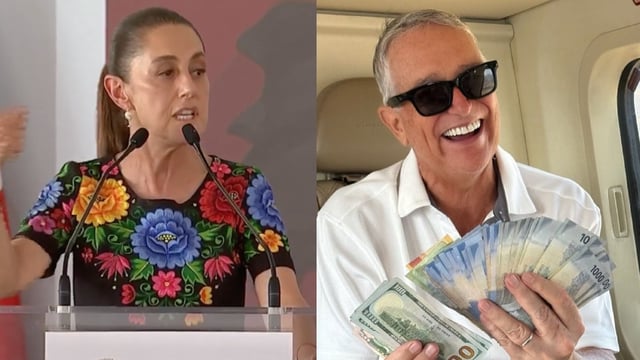

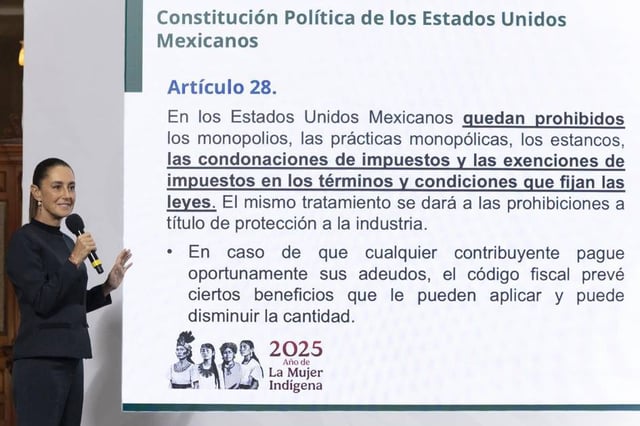

- President Claudia Sheinbaum said the government will not negotiate tax liabilities in private and emphasized that the Constitution and the Federal Fiscal Code govern any resolution.

- The Procuraduría Fiscal reported nine litigation cases against four linked Grupo Salinas companies for an official total of 48,382 million pesos over alleged abusive use of fiscal consolidation and inflated or transferred losses.

- Authorities stated that lower courts have mostly ruled in favor of the SAT, and they expect the Supreme Court to issue final rulings soon that would make the credits enforceable.

- Officials highlighted a 2013 claim of 24,968 million pesos tied to the failure to reverse losses after the consolidation regime ended, alongside other cases dating to 2008–2012.

- Ricardo Salinas Pliego proposed an “open, serious and transparent” negotiation table, but the administration declined bespoke talks, and some media report a higher updated figure near 74 billion pesos when surcharges are included.