Overview

- The fiscal prosecutor said nine tax cases totaling 48,382 million pesos against four Grupo Salinas companies are pending resolution at the Supreme Court.

- A flagship case for fiscal year 2013 seeks 24,968 million pesos over alleged failure to reverse previously used losses after leaving the consolidation regime, with lower courts siding with the SAT and a final ruling awaited.

- Authorities describe a repeated scheme using undue losses, internal transfers, and artificial mergers or divisions to reduce taxes, and report SAT victories in most instances so far.

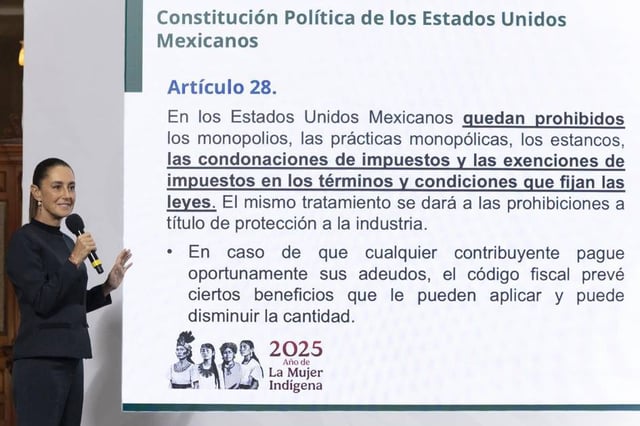

- President Claudia Sheinbaum ruled out private bargaining, citing Article 28 and stating that only legally established mechanisms such as discounts on fines and surcharges apply when debts are paid.

- Ricardo Salinas Pliego proposed an open, transparent negotiation table and said his firms will pay what the law requires, as related U.S. pressures include a $25 million bond in an AT&T-linked contempt case and $500 million claims by TV Azteca bondholders.