Overview

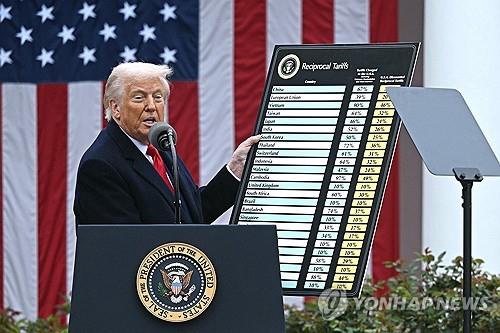

- The newly formalized U.S.–South Korea trade deal fixes reciprocal tariffs at 15 percent on Korean imports in return for $350 billion in American investment pledges.

- The KOSPI closed down 126.03 points, or 3.88 percent, at 3,119.41 on Friday, marking its steepest one-day drop since April amid volatile market swings.

- Seoul’s finance ministry unveiled plans to raise corporate tax rates by one percentage point and increase the stock transaction levy from 0.15 percent to 2 percent.

- Heavy selling by foreign and institutional investors drove the Korean won past 1,400 to the dollar for the first time in two months.

- Chipmakers and shipbuilders led the declines while automakers saw more muted movement as investors weighed tariff burdens against looming fiscal policy shifts.