Overview

- On July 29, Senator Cynthia Lummis unveiled the 21st Century Mortgage Act, which would require Fannie Mae and Freddie Mac to factor borrowers’ cryptocurrency holdings into single-family mortgage reserves without converting them to U.S. dollars.

- The bill formalizes a June 25 directive from FHFA Director William Pulte instructing the government-sponsored enterprises to draft guidelines for recognizing digital assets in risk evaluations.

- Lummis argues that updating eligibility criteria will address a generational homeownership slump—just 36.6% of Americans under 35 own homes—and reflect the growing role of crypto in young Americans’ wealth portfolios.

- Senate Democrats including Elizabeth Warren, Bernie Sanders, Jeff Merkley, Chris Van Hollen and Mazie Hirono warned in a July 25 letter that unconverted digital assets could introduce volatility and liquidity risks to the housing market.

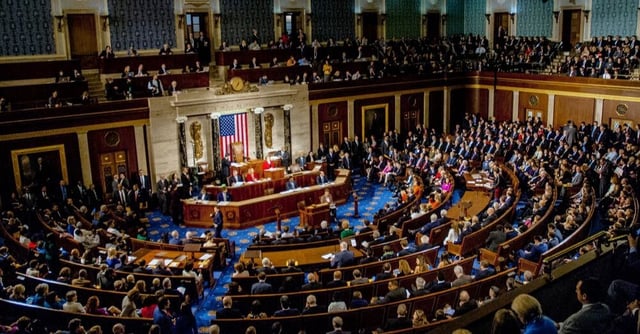

- With Fannie Mae and Freddie Mac preparing plans and lawmakers divided, the bill’s success in Congress remains uncertain as legislators weigh expanded access against financial stability concerns.