Overview

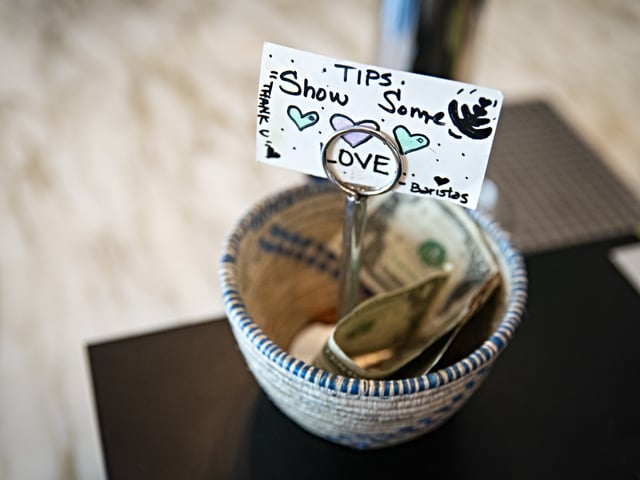

- The No Tax on Tips Act, which allows workers to deduct up to $25,000 in reported tips from federal taxes, passed the Senate via unanimous consent on Tuesday.

- The legislation, applicable to workers earning under $160,000 annually, was first proposed by President Trump during a 2024 campaign rally in Nevada.

- Sen. Jacky Rosen, a Democrat from Nevada, secured swift Senate passage using a rare procedural maneuver typically reserved for noncontroversial matters.

- The House is now considering the bill either as part of a larger GOP tax and spending package or as a standalone measure, with Democrats pushing for the latter.

- The Congressional Budget Office has yet to score the Senate's permanent version, while a temporary House proposal is estimated to cost $40 billion over four years.