Overview

- The Senate passed the 'No Tax on Tips Act' by unanimous consent on May 20, 2025, marking rare bipartisan agreement on a substantive policy change.

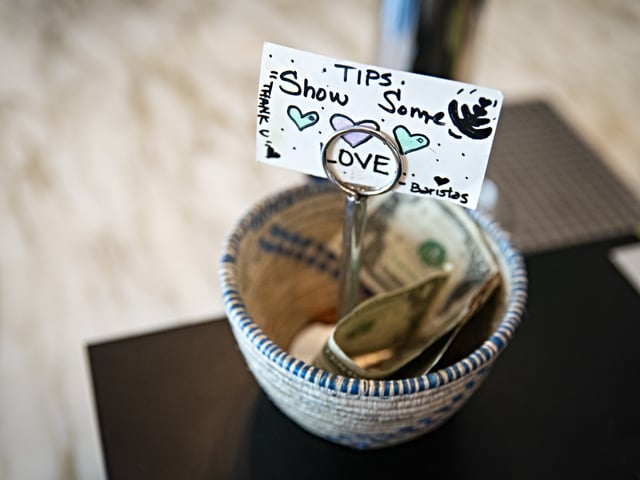

- The bill, introduced by Sen. Ted Cruz and co-sponsored by Sens. Jacky Rosen and Catherine Cortez Masto, allows tipped workers to deduct up to $25,000 in reported tips from federal income taxes.

- Eligibility for the deduction is capped at workers earning $160,000 or less annually, with adjustments for inflation in future years.

- The legislation now advances to the House, where it could be passed as a standalone bill or included in a broader Republican-led spending and tax package.

- Nevada, with the highest concentration of tipped workers, played a key role in shaping the bill, which aims to provide immediate financial relief to service industry employees.