Overview

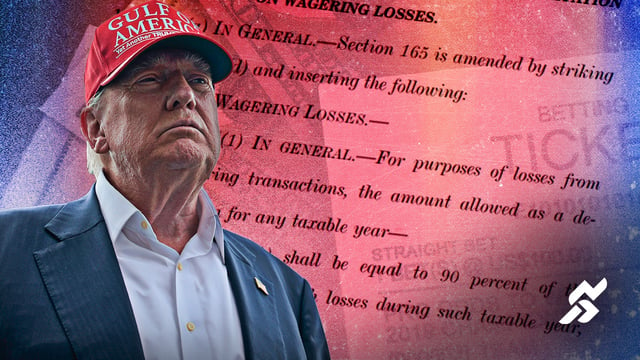

- The Senate’s budget reconciliation bill would allow gamblers to deduct only 90% of their losses against winnings, with the change taking effect in 2026.

- Lawmakers passed the amendment by a 51-50 vote, and the measure now returns to a House version that currently omits any gambling provisions.

- The Joint Committee on Taxation projects the deduction cap will raise about $1.14 billion in additional revenue from 2026 through 2034.

- The American Gaming Association and bipartisan members of Congress are lobbying to restore full loss deductions or expand netting for all wagers.

- Professional poker players and equity analysts warn the limit could drive high-stakes bettors to offshore or illegal markets, threatening U.S. operator revenues.