Overview

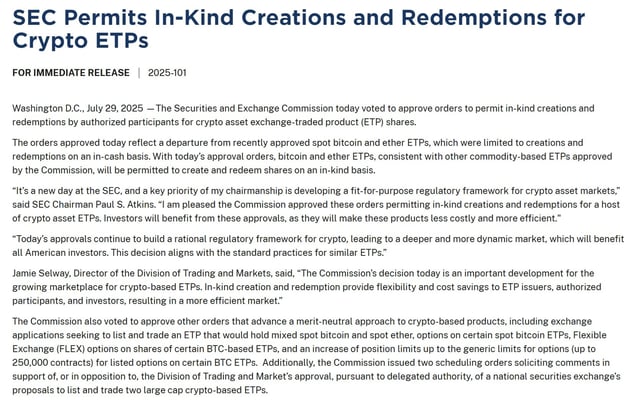

- Authorized participants can now exchange shares of spot Bitcoin and Ethereum ETFs directly for BTC or ETH through in-kind creations and redemptions.

- The approval covers all spot Bitcoin and Ethereum ETFs from major issuers such as BlackRock, Fidelity, Ark Invest and VanEck.

- Position limits for options on Bitcoin ETFs have been raised to 250,000 contracts to enhance hedging flexibility and deepen liquidity.

- The SEC has issued scheduling orders to seek public comment on proposed large-cap crypto ETP listings under its fit-for-purpose framework.

- Analysts expect upcoming altcoin ETF filings to adopt in-kind mechanisms from launch, mirroring the efficiency gains in Bitcoin and Ethereum funds.