Overview

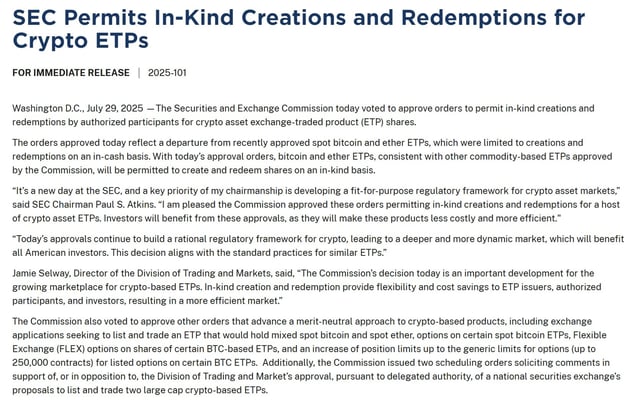

- The SEC approved orders allowing authorized participants to create and redeem shares of all spot Bitcoin and Ethereum ETFs directly in the underlying crypto rather than cash.

- This decision replaces the initial cash-only model and brings crypto exchange-traded products into alignment with in-kind practices used by traditional commodity ETFs.

- Regulators also green-lit mixed Bitcoin-Ether funds, authorized listed and FLEX options on Bitcoin ETFs, and raised position limits for Bitcoin ETF options to 250,000 contracts.

- SEC Chair Paul S. Atkins described the changes as part of a fit-for-purpose regulatory framework designed to lower costs and improve market efficiency.

- Analysts expect the in-kind framework to pave the way for future altcoin ETF filings to include direct token settlements from their launch.