Overview

- The Securities and Exchange Board of India (SEBI) has warned two Mauritius-based funds, Elara India Opportunities Fund and Vespera Fund, with penalties and potential licence cancellations for non-disclosure of shareholding details.

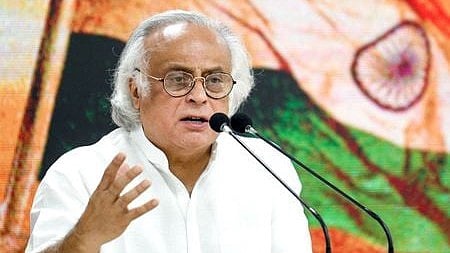

- Congress alleges that these funds acted as fronts for undisclosed Adani investments, violating SEBI regulations on transparency and governance.

- The offshore funds have reportedly offered to settle the matter by paying a token fee without admitting guilt, a move Congress criticizes as lenient.

- SEBI's investigation into Adani-linked offshore holdings has extended for over two years, despite a Supreme Court directive to conclude it within two months in mid-2023.

- The Adani Group denies all allegations, asserting full compliance with laws, while Congress accuses the government of attempting to cover up what it calls 'India's biggest scam.'