Overview

- The SAT’s July 22 bulletin, Tarjeta Informativa 09, debunked rumors that the Constancia de Situación Fiscal (CSF) will be phased out.

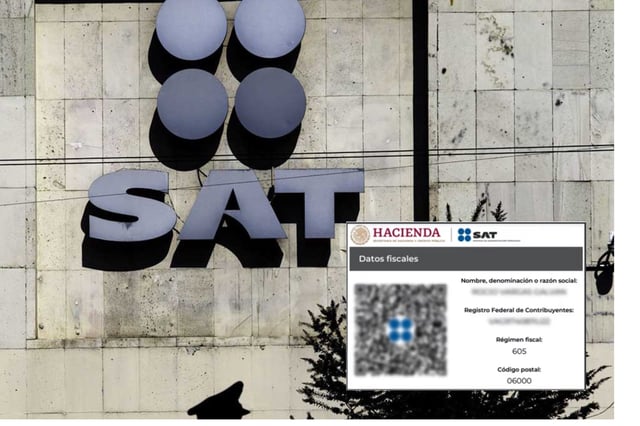

- The new Cédula de Datos Fiscales (CDF) collects only essential fields—name, RFC, fiscal regime, address, CFDI usage and a QR code—to meet electronic invoicing requirements.

- Taxpayers can choose the CDF for issuing CFDI version 4.0 and retain the CSF for detailed administrative and fiscal procedures.

- Privacy advocates have supported the CDF’s minimal-data design to reduce exposure of sensitive information contained in the CSF, such as obligations and economic activities.

- The CSF continues to be required for RFC registration, updates and comprehensive tax declarations, underscoring its enduring role in Mexico’s tax system.