Overview

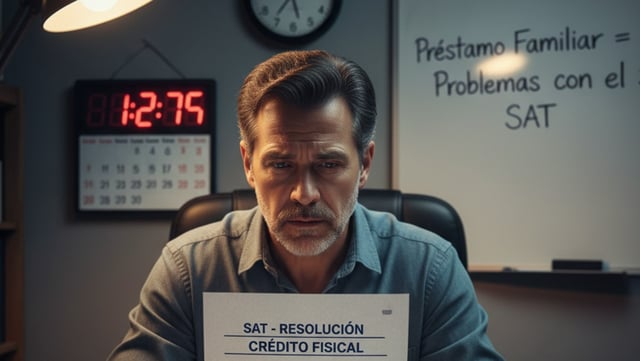

- Individuals must inform the SAT in their annual return when loans, donations or prizes, individually or combined, surpass 600,000 pesos in a fiscal year, as set out in Article 90 of the Income Tax Law.

- If amounts over that limit are not reported, the SAT may initiate a Discrepancia Fiscal under Article 91, and unproven funds can be treated as taxable income.

- Upon a discrepancy notice, taxpayers have 20 days to document the lawful origin of funds, and the SAT cross-checks information using bank data and third-party reports.

- Administrative penalties reported by outlets can reach roughly 35,000 pesos per infraction, and taxpayers may also face surcharges and updates on assessed amounts.

- Proportional fines can range from 20% to 75% of the omitted amount, while small, good‑faith family loans that stay under the threshold are not illegal and generally need not be declared.