Overview

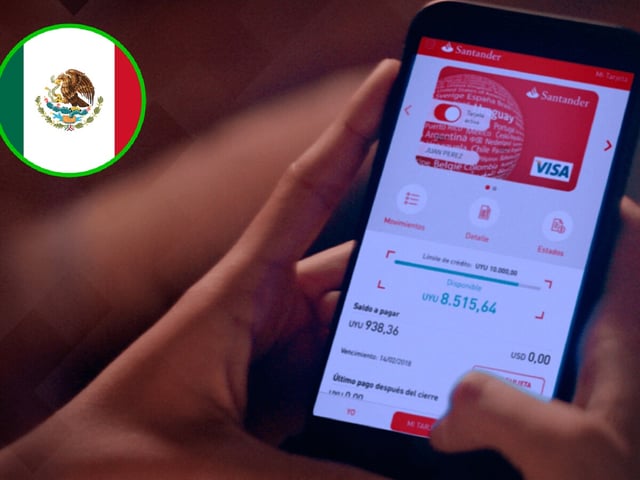

- Effective October 2, Santander scrapped its $15 per-transfer charge for international account-to-account transfers made through the SuperMóvil app, which the bank says is a permanent change.

- The zero-fee service supports seven currencies—USD, EUR, GBP, CHF, SEK, JPY and CAD—runs 24/7, and has no minimum amount or daily limit on the number of transactions.

- Eligibility requires an active peso account, mobile banking access and an active SuperToken, and the benefit is applied automatically to customers who meet those conditions.

- Transfers are between bank accounts only and not cash remittances, with receipt times ranging from minutes to up to 72 hours depending on foreign intermediaries.

- Senders must provide beneficiary bank details such as SWIFT or ABA and account number, and USD transfers to the U.S. require a Wire Transfer Number; the rollout comes as MTU limits take effect with an automatic default of 1,500 UDIS (about 12,800 pesos) if users do not set their own, while rivals like BBVA have reduced—but not eliminated—fees.