Overview

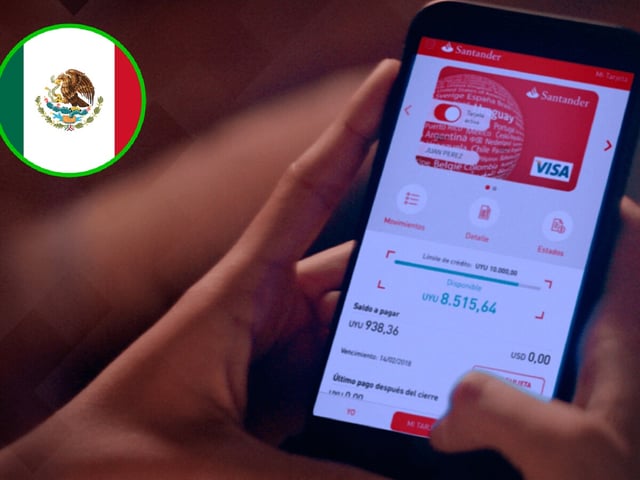

- Effective October 2, Santander removed the $15 charge and now offers zero‑commission international transfers sent from its SuperMóvil app.

- The service runs 24/7 in seven currencies (USD, EUR, GBP, CHF, SEK, JPY, CAD) with no minimum amount or daily transaction cap, and it covers account‑to‑account payments only from Mexico to other countries.

- Customers receive the fee waiver automatically; transfers require beneficiary details such as SWIFT or ABA and, for U.S. dollar payments to the United States, a Wire Transfer number, with delivery ranging from minutes to up to 72 hours.

- Intermediary or receiving banks may still apply charges, and Santander emphasizes encryption and regulatory compliance as the MTU user‑defined limit rule takes effect.

- Executives said transaction volumes doubled after the digital launch, prompting the change, while competitors like BBVA reduced—but did not eliminate—digital international transfer fees earlier this year.