Overview

- The Spanish government must decide by June 27 whether to impose additional conditions or escalate BBVA’s hostile takeover bid after the CNMC approved it with safeguards.

- Banc Sabadell has received nonbinding approaches for its UK arm TSB and will only consider a sale that maximizes shareholder value, convening an extraordinary meeting if a suitable offer emerges.

- Analysts estimate bids of £1.7 billion to £2 billion for TSB could free €1.6 billion–€2 billion in excess capital, enabling Sabadell to more than double this year’s dividend payout.

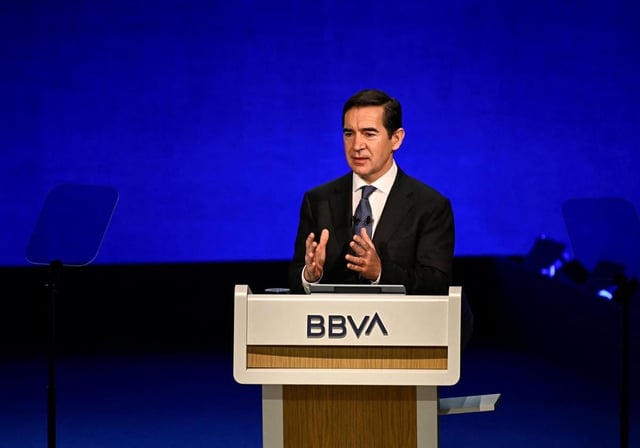

- BBVA President Carlos Torres warned that the bank may pursue legal action if the government imposes new conditions beyond those agreed with the CNMC, arguing obstacles would damage investors and the wider economy.

- Regulators at the CNMV will examine the viability of holding a shareholders’ vote on a TSB sale during the takeover period and assess implications for market competition and Sabadell’s size.