Overview

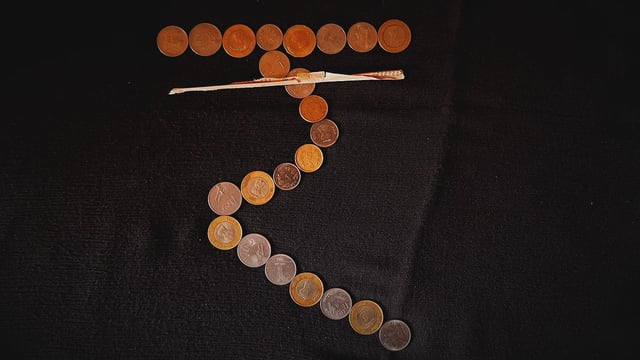

- The rupee opened at 85.98 per dollar on July 16 after stronger-than-expected US inflation readings reduced hopes for an imminent Federal Reserve rate cut.

- President Trump’s announcement of 30% tariffs on European Union and Mexican goods has unsettled global markets and weighed on the rupee.

- India’s foreign exchange reserves, which exceed $700 billion, and the Reserve Bank of India’s defined trading band have constrained the rupee within a narrow two-week range.

- Low realized volatility in the currency has prompted corporates and interbank participants to increase selling of one-week to one-month rupee volatility.

- An Indian commerce ministry delegation is in Washington for bilateral trade agreement negotiations that could shape future capital flows and influence the rupee’s direction.