Overview

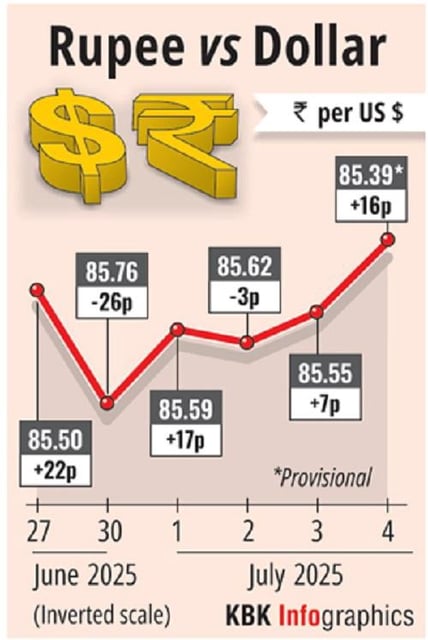

- The rupee traded in a narrow band of 85.34–85.39 per dollar on July 4 after closing at a one-month high of 85.32 on July 3 on optimism over an India-US trade agreement.

- Robust US non-farm payrolls and a firmer dollar delayed expectations of a Federal Reserve rate cut, curbing the rupee’s gains despite trade-deal prospects.

- Markets are bracing for letters specifying tariffs to countries without deals by July 9, prompting exporters to hedge near 86.00 and importers around 85.20–85.50.

- Brent crude held near $68.50 a barrel ahead of the July 6 OPEC+ meeting, with oil-import costs remaining sensitive to Middle East tensions and supply decisions.

- The Reserve Bank of India’s record $693 billion in forex reserves underpins its capacity to intervene, keeping the rupee range-bound ahead of key policy and trade milestones.