Overview

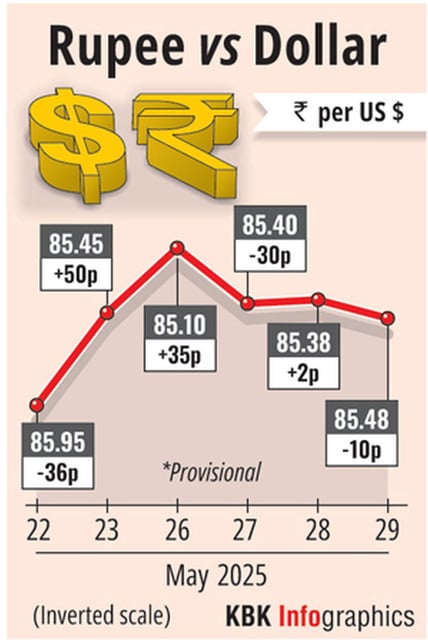

- On May 29, the rupee closed at 85.53 per US dollar, marking its third consecutive session of losses.

- The US dollar index climbed past 100.50 after Federal Reserve minutes indicated a pause in rate cuts, bolstering the greenback.

- Brent crude oil prices rose about 1.2% ahead of an OPEC+ supply meeting, increasing import costs for India.

- India’s industrial production growth slowed to 2.7% in April as manufacturing, mining and power sectors underperformed.

- Reserve Bank of India’s balance sheet expanded 8.2% year-on-year to ₹76.25 lakh crore by March 31, but interventions did not prevent the rupee’s slide.