Overview

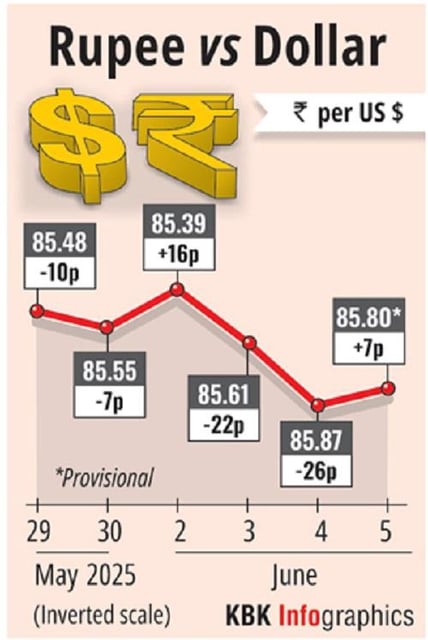

- The rupee snapped its two‑day slide to finish at 85.80 against the US dollar on June 5 after opening stronger and swinging between 85.67 and 85.96.

- Markets are pricing in a potential 25 to 50 basis point rate cut when the RBI’s Monetary Policy Committee announces its decision on June 6.

- Firm global crude oil prices have kept India’s import bill high, adding downward pressure on the currency.

- Persistent foreign institutional outflows have compounded the rupee’s weakness despite India’s robust 7.4% GDP growth in the first quarter.

- With foreign exchange reserves near $693 billion, the RBI remains equipped to intervene if volatility intensifies.