Overview

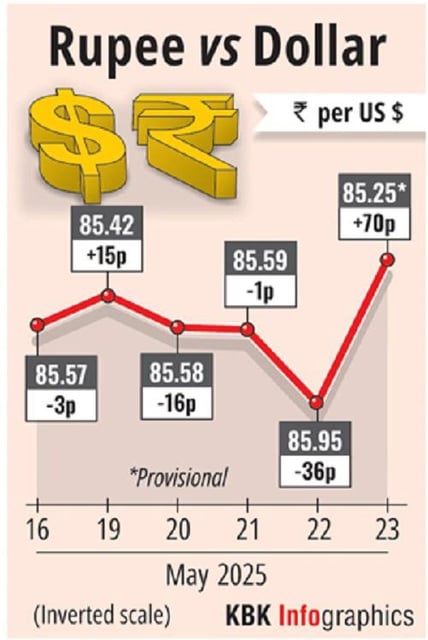

- The rupee initially fell to 86.10 in early trade on May 23 due to foreign institutional investor sell-offs driven by a two-decade low bond yield differential.

- By the end of the trading day, the rupee strengthened to 85.22 against the US dollar, recovering 79 paise from its earlier low.

- Strong domestic economic indicators, including a 14-month high Services PMI of 61.2 and a Manufacturing PMI of 58.3, supported the rupee's recovery.

- Signs of fatigue in the US Dollar Index, influenced by mounting US fiscal concerns, provided additional relief to the rupee and other Asian currencies.

- Speculation around an upcoming Reserve Bank of India rate cut, fueled by declining food and energy prices, also influenced market sentiment.