Overview

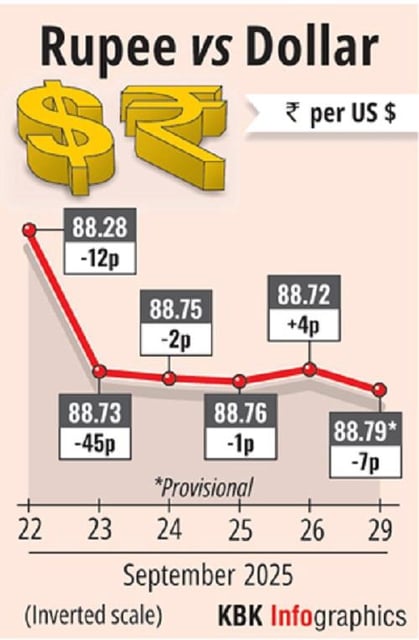

- The currency posted a provisional all-time closing low of 88.79 per dollar on Sep 29 after trading near lifetime troughs through the session.

- In early trade on Sep 30, the rupee edged up to about 88.72 on softer crude and firmer Asian peers, but gains were restrained by ongoing foreign portfolio outflows.

- Market participants reported RBI dollar sales via state-run banks in recent sessions to temper depreciation ahead of the Monetary Policy Committee outcome.

- Exchange data showed persistent selling by foreign investors, including Rs 5,687.58 crore of equity outflows on Friday and Rs 2,831.59 crore on Monday, while one-month NDFs hovered near 88.8 with onshore forward premiums around 15 paise.

- RBI data indicated forex reserves fell by USD 396 million to USD 702.57 billion for the week ended Sep 19, as U.S. tariff moves and a higher H‑1B visa fee kept sentiment cautious toward Indian exporters.