Overview

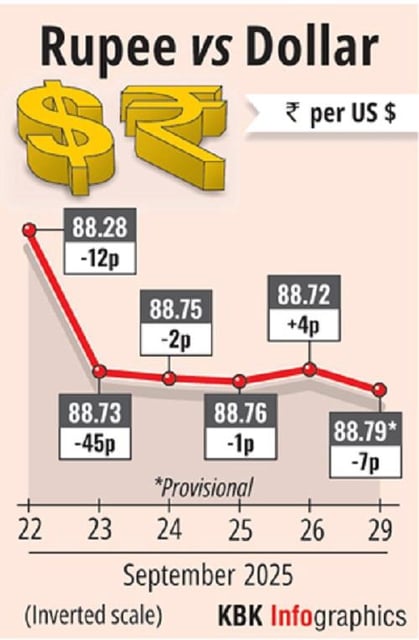

- Spot USD/INR traded around 88.75–88.81, with reports of a fresh intraday low near 88.8050 as pressure on the rupee persisted into Tuesday.

- Foreign investors remained net sellers, with equity outflows reported at about Rs 5,687 crore on Friday and Rs 2,832 crore on Monday, weighing on risk sentiment.

- Traders said the RBI sold dollars via state-run banks to curb volatility rather than defend a level, and forex reserves dipped by USD 396 million to USD 702.57 billion for the week to Sept. 19.

- Quarter-end technical stress lifted the one-day dollar/rupee swap to about 1.21 paisa, implying rupee funding near 9% and reflecting strong short-term dollar demand.

- External headwinds included U.S. tariff actions and higher H‑1B visa fees, even as U.S. PCE data kept Fed rate-cut expectations intact and oil prices eased.