Overview

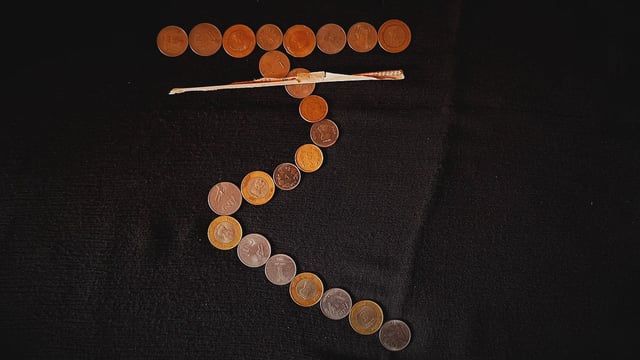

- The rupee opened at 85.85 per dollar on July 9 and closed marginally stronger at 85.68 after expected India-US mini trade deal overnight failed to materialize

- White House letters imposing 25–40% duties from August 1 have sustained downward pressure on the currency by stoking tariff policy uncertainty

- Brent crude reached two-week highs above $70 on Red Sea supply concerns before easing, keeping oil importers’ dollar demand elevated

- Foreign institutional investors offloaded equities earlier in the week before modest inflows returned, reflecting shifting capital flows

- India’s forex reserves climbed to a record $702.78 billion, giving the RBI scope to intervene and cap rupee moves within an estimated 85.30–85.80 range