Overview

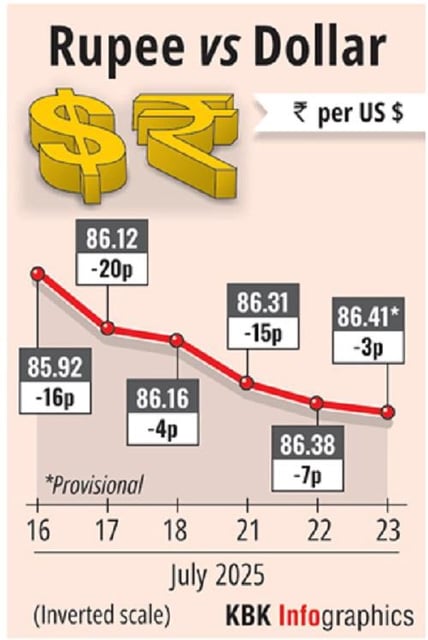

- The rupee opened at ₹86.57 per dollar on July 25—its weakest level since late June—and closed the week at ₹86.52, down 11 paise.

- A firmer US dollar index and Brent crude trading above $69 per barrel have intensified selling pressure on the local currency.

- Uncertainty over a proposed bilateral trade agreement with the United States has constrained the rupee within tight intraday ranges.

- Persistent foreign portfolio outflows and subdued domestic equity trends have limited any sustained appreciation of the rupee.

- Investors are focusing on the US team’s upcoming August visit for the next round of negotiations, while the Reserve Bank of India’s near-record forex reserves could be tapped to smooth volatility.