Overview

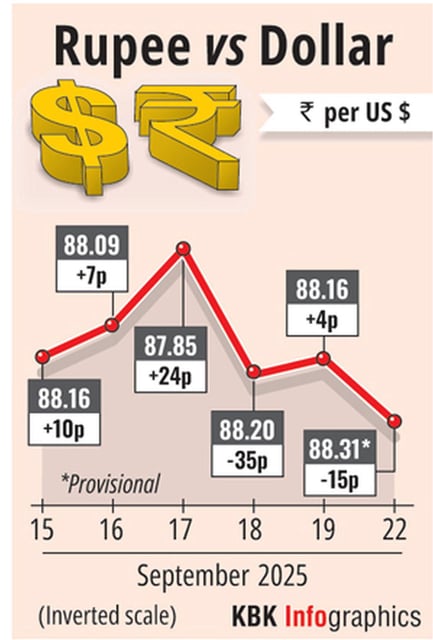

- The currency dropped to an intraday low of 88.76 on Tuesday after earlier prints near 88.48, with NDTV reporting a record close around 88.50.

- Market participants linked the slide to steeper US tariffs on Indian goods and a $100,000 H‑1B visa fee for new applications, raising concerns for IT revenues and remittance momentum.

- Foreign investors sold about Rs 2,910 crore of equities on Monday and one‑month NDF pricing pointed to further pressure despite a softer dollar and lower oil.

- Traders said the RBI likely supplied dollars via state‑run banks but kept overt intervention restrained, allowing greater two‑way volatility.

- In contrast, Pakistan’s rupee extended gains to 281.45 in the inter‑bank market, with SBP data showing August’s current account deficit at $245 million and reserves near $14.36 billion.