Overview

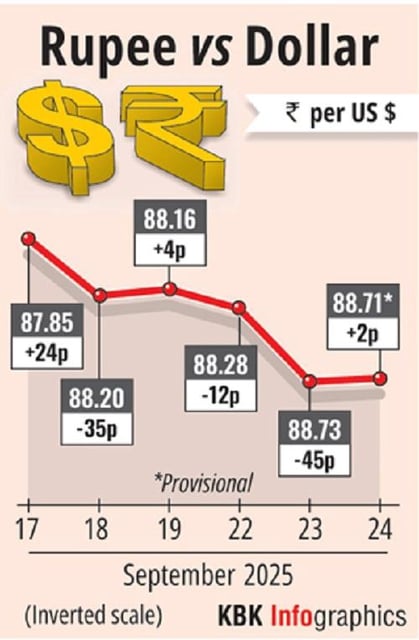

- The rupee set a fresh lifetime closing low of 88.76 per dollar on Thursday after a 88.75 record the prior session, then ticked up to about 88.70 in early trade Friday.

- Exporters’ dollar sales and suspected Reserve Bank of India intervention curbed a deeper slide, with traders describing a measured depreciation stance near the 88.70 level.

- Market weakness has been linked to new U.S. tariffs on Indian exports, a sharp H‑1B visa fee increase, and sustained foreign portfolio outflows.

- Domestic equities extended losses on Thursday as the Sensex fell 555.95 points to 81,159.68 and the Nifty slipped to 24,890.85, while FIIs sold ₹4,995.42 crore worth of shares.

- Analysts see USD/INR trading near 88.40–89.10 in the near term, with flows, crude prices, U.S. data, and outcomes from ongoing India–U.S. trade talks in focus.