Overview

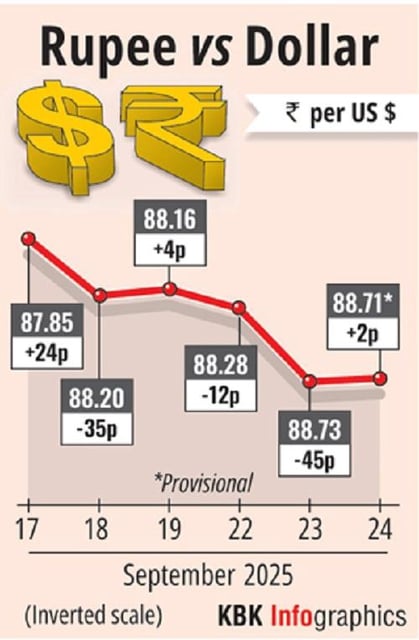

- The rupee ended Thursday at 88.68 per dollar, a 7‑paise recovery from Wednesday’s record closing low of 88.75 after a tight session.

- Suspected Reserve Bank of India dollar sales and exporter supply helped steady the exchange rate despite weak risk sentiment.

- Market pressure reflected US tariff actions, a higher H‑1B visa fee and foreign outflows, with FIIs selling ₹2,425.75 crore of equities on Wednesday.

- In early trade the currency briefly strengthened to 88.60 as the dollar index eased and crude prices held mixed near the USD 69 mark.

- Analysts expect USD/INR to trade around 88.40–89.10/89.25, with dollar momentum, any RBI action and US–India trade discussions seen as key supports.