Overview

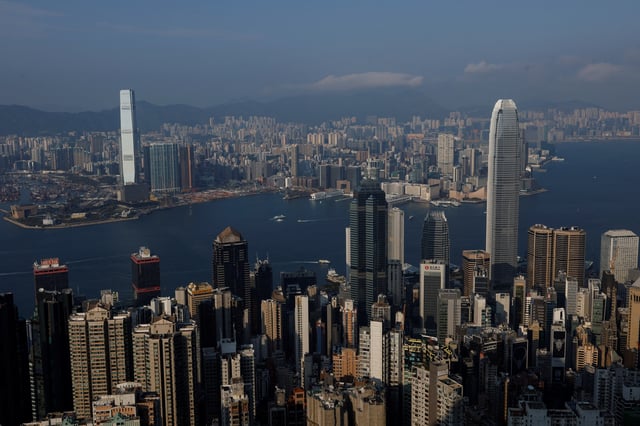

- Developers face nearly 70 percent higher bond maturities in 2026, climbing to $7.1 billion from $4.2 billion this year.

- Road King’s recent coupon default marked the first city-based developer bond default since the 2021 property crisis.

- HSBC’s revised internal model flagged $18.1 billion of Hong Kong commercial real estate loans as high credit risk at end-June.

- Hang Seng Bank set aside HK$2.5 billion in expected credit losses for commercial property in the first half of the year.

- Lenders are delaying loan recalls and refraining from asset seizures to buy time for market stabilization and prevent wider contagion.